Quotient Onsite Media for Retailers

Quotient’s retailer.com media and sponsored search platform powers many of the top grocery chains in the U.S.

which account for over $132 billion in grocery sales annually with over 20,000 store locations across all 50 states.

End-to-End Measureable Capabilities at Scale

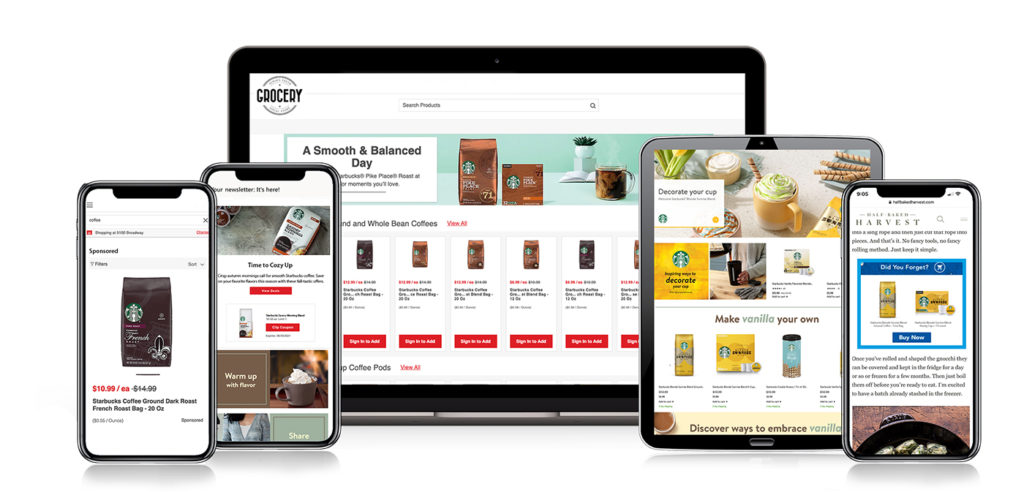

SPONSORED SEARCH

Premium sponsored product placements on retailer.com to increase engagement and sales at every touchpoint.

Learn More →

In-email banners and product placements delivered directly to consumers, promoting the products and brands relevant to them.

RETAILER.COM DISPLAY

Targeted display media placements across eCommerce platforms that maintain your site’s look and feel.

Learn More →

INTEGRATED PROMOTIONS

Digital offers run alongside sponsored product placements to further incentivize shoppers.SHOPPABLE BRAND PAGES

Custom-built pages for specific brands populated with product placements, display media, coupons and offers, relevant content and more.

OFFSITE MEDIA

eCommerce-enabled advertiser-funded social, display and digital out-of-home media driving to retailer.com with remarketing capabilities. Learn More →

Quotient Powers the Nation's Leading Retailers

Solving Retailers' Biggest Challenges

Increase Traffic

to Retailer.com

_____

Ensure today’s digital consumer is actively using eCommerce properties to buy online, research upcoming purchases, and plan their trip to store.

Create Seamless

Omnichannel Experiences

_____

Ensure your digital and physical shopping experiences are integrated and easy to navigate for today’s savvy, convenience-motivated consumer.

Drive New

Revenue Opportunities

_____

Provide premium advertising opportunities for top advertisers and ensure they can measure across in-store and online activity.

Industry-Leading Technology & Service Model

01

Maximize Your Inventory

Single ad server to power integrated media and promotions designed to boost omnichannel traffic and sales.

02

Performance Technology

Customer segmentation and targeting, ad server speed, relevancy engine, ad blocking technology and SEO targeting capabilities.

03

Increased Demand Opportunity

Managed, self-serve and API options powered by a 200+ person go-to-market team and in-network demand partners.

04

Real-time Analytics

Performance dashboard with on-demand analytics and full-service reporting options with ability to measure online and in-store attributable sales.

We Are Ready to Get Started. Are You?

Get in touch to start designing your omnichannel strategy with Quotient.